At the start of the year, we meet with traders on the desk to review their goals. In this webinar, Mike shared what you can learn from the goals set by our traders for 2018.

[Recording] SMB Webinar: Lessons on 2018 Trading Goals from the Desk

SMBU’s Options Tribe Webinar: Dr. Brett Steenbarger, Renowned Author and Trading Coach: “How the Markets are Moved by the Major Hedge Funds and Money Managers”

January 30th, 2018

This week, Dr. Steenbarger returns to the Options Tribe to share what he has gleaned from dealing with some of the largest portfolio managers in the world and how their thinking and decision making affects the markets. Dr. Steenbarger will also set aside a portion of the meeting to answer traders important questions about how to improve their trading performance.

Options Tribe meetings are generally free to the public and are held every Tuesday at 4:30PM ET. If you wish to register to this meeting, please click here.

We look forward to seeing you at the meeting!

Seth Freudberg

Director, SMB Options Training Program

The SMB Options Training Program is an eight-month program designed for novice and intermediate level options traders who are seeking an intensive training process to learn how to trade options spreads for monthly income. For more information on this program contact Seth Freudberg: sfreudberg@smbcap.com.

No relevant positions

Risk Disclaimer

Futures Risk Disclaimer

We can make more trading in 2018

My son Luke took his Kindergarten G&T test this weekend in NYC. Before I left for the airport to partner’s meetings in Austin, he was up and we talked about his big day. Luke was so excited to take a test, his first test.

Lukey and I have been training for this test everyday since the end of the summer. We called it “Kindergarten homework”. Which he thought was just about the coolest thing isn’t he world.

He struggled at first.

But we focused on improvement and choosing the best answer.

When he got stuck and frustrated, we tried to figure out the answer together, and think thru the best answer together.

Coincidentally, around the same time, we tried this delicious new key lime fish oil that tastes like key lime pie at his Poppi’s and turned that into a habit. When he started improving at Kindergarten homework, Lukey started equating such improvement with taking his fish oil.

“Dad I have to take my fish oil so I can get better at Kindergarten homework,” he would say before bed.

Not gonna argue with that.

I called home after we landed in Austin and asked how he did.

He pronounced: “I got all the questions right.”

His mom asked if the teacher told him so.

Lukey said, “No I just know that I did.”

Who can argue with that?

He was so happy after the test. And we can learn as traders from this youthful happiness. What drove this happiness? Growth, excitement to try something new, being challenged.

Our kids can teach us how we can do better as traders. Lukey’s experience can provide color for how we can all make more in 2018. Growth, excitement to try something new, being challenged!

2017 was a very strong year for NYC.

How?

We were open minded to try something new- crypto, blockchain.

Traders challenged themselves to learn a new product.

They grew as traders learning to trade a product with a larger spread.

They pushed to trade a product with a larger price, more risk and more reward in the very hottest sector on the planet.

Kinda like Lukey.

Doubling down on growth, excitement to try something new and challenging ourselves can help us drive making more in 2018.

Was it just crypto and blockchain that brought higher PnL? Or was it that youthful excitement to grow?Was it that youthful open mindedness to find edge in a new product? Was it the newness of moving to stocks not crowded with HFTs, where their skills are superior?

Just like Lukey is forever different after taking his G&T test so are you. You are better traders. That part does not go away even if GBTC does.

How do we take our edge and apply it to new areas?

What can you accomplish in 2018 if you keep growing, being open minded to new experiences, and challenging yourself?

Our top trader in NYC, sat with us for his 2018 goals at the start of this month. He is an excellent role model for anyone in the trading community seeking to make more.

After earning a black shirt this year, and top trader at the firm, he set clear goals to be better in 2018.

He wrote:

Bigger picture, I am also thinking about making the incremental steps to be a 10 million dollar a year trader.

What incremental work can you do to make more in 2018?

2017 is a great year from which to build. We can make more in 2018. And like Lukey, let’s remember how exciting it is to grow, experience things new and challenge ourselves.

I am grateful for your feedback/questions/comments- mbellafiore@smbcap.com.

*no relevant positions

SMBU’s Options Tribe Webinar: Options Tribe Member Kim Kromas: Creating the Vertical-Butterfly-Calendar Trade Through Simulation

February 6th, 2018

This week, Options Tribe member Kim Kromas makes her first presentation on the Options Tribe to discuss her newly developed Vertical-Butterfly-Calendar trade and the process that she went through to create the trade.

Options Tribe meetings are generally free to the public and are held every Tuesday at 4:30PM ET. If you wish to register to this meeting, please click here.

We look forward to seeing you at the meeting!

Seth Freudberg

Director, SMB Options Training Program

The SMB Options Training Program is an eight-month program designed for novice and intermediate level options traders who are seeking an intensive training process to learn how to trade options spreads for monthly income. For more information on this program contact Seth Freudberg: sfreudberg@smbcap.com.

No relevant positions

Risk Disclaimer

Futures Risk Disclaimer

[Recording] SMB Webinar: Breakout Trade

Mike Bellafiore discussed the variables to consider for the best Breakout Trades. How to develop A+ Breakout Trades for your PlayBook. This is a particularly important trade for this strong market.

SMBU’s Options Tribe Webinar: SMB Options Desk Trader John Locke: The Bearish Butterfly—Play to Win

February 13th, 2018

This week, John Locke returns to the Options Tribe to discuss his signature Bearish Butterfly trade, one of the most widely traded options strategies in the world.

Options Tribe meetings are generally free to the public and are held every Tuesday at 4:30PM ET. If you wish to register to this meeting, please click here.

We look forward to seeing you at the meeting!

Seth Freudberg

Director, SMB Options Training Program

The SMB Options Training Program is an eight-month program designed for novice and intermediate level options traders who are seeking an intensive training process to learn how to trade options spreads for monthly income. For more information on this program contact Seth Freudberg: sfreudberg@smbcap.com.

No relevant positions

Risk Disclaimer

Futures Risk Disclaimer

The Black Shirt

There is a Green Shirt that hangs on the wall of our trading floor. You earn the Green Shirt for posting 1m net in trading profits.

And then there is the Black Shirt. For that a firm trader must earn north of 2m in net profits.

The firm challenged the trader above, a Black Shirt recipient for 2017, approximately 4 years ago to make 30k in a month. We called it the 30k challenge for our developing and younger traders. It has been fun to see some of them progress so much to earn a Green Shirt and Black Shirt.

How did this trader improve so dramatically to earn a Black Shirt?

- Sizing. He trades much larger, focusing on the same trades he was making years ago.

- Team Trading. His Team helps him make so much more.

- Technology. We are fortunate to partner with Kershner Trading Group, who has built the best technology on the Street in our space. Filters, scripts, models allow traders to play more offense in the markets.

- 7-Figure Traders around him. He trades better because the traders around him have improved dramatically as well.

- Capital. He has a very large trading book, one of the largest on the Street for day trading.

- Building from his strengths. He has a particular talent that he expresses in markets.

- Coaching. This trader has the good fortune to be coached by Dr. Steenbarger, who works with some of the biggest and best traders in the world.

From my seat……

Capital really helps you make more. Technology really helps you make more. An improved trading environment really helps you make more. Team trading really helps you make more. Sizing up in your strengths really helps you make more. Coaching really matters.

Now that next level is: 8-figure trader.

Your comments/feedback/questions are welcome- mbellafiore@smbcap.com.

*no relevant positions

[Recording] SMB Webinar: The Daily Report Card

Mike Bellafiore has been mentoring an independent trader through The Daily Report Card process. That trader joined us in a live webinar to share how The Daily Report Card has helped his trading.

This independent trader shared his trading journey with you. At SMB Training, we are most interested in working with and meeting the most serious of traders and helping them grow. And even better yet, hiring them on our desk.

Learn more about how you can work with Bella at smbu.com/reportcard

Meeting traders in Chicago next week because you ALWAYS trade with stops

This was a bittersweet week for traders on the Street.

The sweet? We saw one of our top traders post three 200k days. In one week, he made nearly as much as his best month ever. His goal of making 8-figures in a year became more of a reality.

Our options desk struggled. They shorted volatility and got stopped out. But, but, but… they got stopped out to live to play another day. They lost ONLY the amount of their max loss. Strong risk management brought losses, but losses that are manageable.

One of my trading colleagues said bluntly, summing up this week perfectly, to a star trader,”You always trade with stops. Always!”

The risk management at our desk in NYC has improved greatly since inception. (Think KBIO.) Dr. Steenbarger has taught me so much about the best way to think about risk management from the firm’s and trader’s perspective.

The bitter? Four friends and/or friends of friends at trading firms lost more than, as described to me by one trader, “what they could make in a trading career”. All of these traders were consistent 5m plus per year traders. All of them. A failure of risk management in one after-hours moment with volatility products (read Howard Lindzon on this) challenged their very trading careers.

When hearing unfortunate stories like these great traders losing so much, it reminds us to adhere to our stops as traders. And double down on our risk management as traders AND trading firms. Each firm is only as solvent as good risk management. If these truly talented, impressively large producers in a few bad moments could get hit so hard, then we all can.

I will be in Chicago this week, Monday and Tuesday, meeting with traders. First, I would like to be there for some good friends and their friends. We say trading is really hard but only veteran traders understand what his really means. It is really hard. How many people can withstand one bad moment causing so much consequence? Second, there are many traders looking for new homes after this week. We are open to discussions with traders looking for a new home. Many are being displaced as a result of this week.

SMB in our JV with KTG offers tremendous value for traders with:

When you trade as long as I have, you will have seen and made every mistake you can make. I shake my head at some of the dumb things I have done as a trader and Managing Partner. For all us, we have to keep getting better and learning from our failures.

I overheard one of our Black Shirt earners saying so much to a new hire just this week outside my office.

Ray Dalio wrote,

“I saw that to do exceptionally well you have to push your limits and that, if you push your limits, you will crash and it will hurt a lot. You will think you have failed – that won’t be true unless you give up. Believe it or not, your pain will fade and you will have many other opportunities ahead of you, though you might not see them at the time.”

I finished my second book, The PlayBook with “You can be better tomorrow than you are today!” Stop losses, risk management, and learning from failure to become better is the large takeaway from this historic week on the Street.

Any traders who want to chat or meetup, I am available- mbellafiore@smbcap.com.

*no relevant positions

Exciting Opportunity for Futures Traders

[Webinar Recording] “The Bearish Butterfly: Play to Win”

Collaborating to build automated models

In his Daily Report Card, a developing hybrid trader noted the important value talking to another trader on the desk about his idea for an automated trading model. (A hybrid trader is one who profits with discretion, AND discretion armed with technology, AND automated models. They are not just a discretionary trader, pushing buttons based upon what they see in markets.) This hybrid trader has been contemplating building a reversal model buying and selling baskets of stocks/products in extreme conditions.

Just before takeoff back to NYC from CHI, I chatted over the phone with this hybrid trader about expanding his idea to consider products and ETFs and not just stocks.

Yesterday this hybrid trader walked over to the desk of another trader and exchanged ideas improving his thought process. Below is this hybrid trader sharing that experience sharing and learning from another trader on the desk:

It was a day I want to study and develop the basket idea around. Speaking with Garret this morning was incredibly helpful in setting the context of the day, not just looking at the ticks but the other measures he looks at as well, they were showing intense strength from the beginning of the day. A day to hold, not look to take profits.

A day like this is a big day for the basket idea. It is certainly one to really take a good look at and evaluate how I would use the basket idea here, how I would create baskets, how those baskets would trade? Even if there are only of 5 of these days a year- they have the potential of being very powerful when executed well.

Further both of these traders have had important input from Dr. Steenbarger on important inputs to consider.

This hybrid trader will now team with other traders, his Team Leader for sure and potentially another junior trader with excellent coding skills, to build a strategy to play more offense and with measured edge for large reversal trades. This strategy will be built by a team of 2 or 3 firm traders.

Notice how this hybrid trader is tapping into the resources at the firm to take his idea and make it better: another junior trader, partner, trading coach, Senior Trader, other junior trader. We find the best models at the firm are built collaboratively.

I appreciate your feedback/comments/questions- mbellafiore@smbcap.com.

*no relevant positions

Related posts

The biggest spark for our trading improvement in 2017

Recruiting traders for Teams that fit their talents

During an interview with now one our new hires, I imagined the candidate trading on one of our specific teams. I thought he could be a very good scalper. I could imagine him succeeding on Team Scalping.

The candidate had a history of very fast thinking. He had done the type of thinking prior to this interview to be good at scalping.

We would have to train him to Read the Tape.

He would have to go thru Foundation and Trader Development so he was properly trained.

Most importantly, he would have to conclude his best trading niche would be scalping and the best team for him would be Team Scalping. (There are different Teams at our firm. We match traders with their best Team, as best we can.)

Towards the end of Foundation, he slipped into my office for a chat. He remarked he thought he could be a good scalper. I responded, “yeah I saw that in your interview. That’s terrific!”

At the end of Trader Development, this trader slipped into my office again. He restated he can scalp.

Hmmm this was working

Now it was time for this trader to interview for a Team. He interviewed for the scalping Team. He was accepted.

That trader slipped into my office again the other day. Beaming, he said, “did you hear I am on Team (Scalping)”. I had never seen him so happy.

In fact, I had heard. (These traders do realize I work here right?)

I checked in with the head of Team Scalping. He was pumped this Trader was gonna be on his Team.

This is gonna be fun to watch this trader grow.

Being on the right Team that fits your talents, when you have talent, breeds very strong traders.

*no relevant positions

Why I Game Plan Every Day

Every morning when I arrive at SMB’s office in midtown Manhattan I have a pre-market routine. The routine serves two purposes: 1) To get me in the proper frame of mind to attack the markets and 2) Ensure that I’m in the best risk/reward stocks and setups.

Here is a brief outline of my pre-market process:

- Login to trading platform

- Open charting software and link to trading platform

- Open SMB Trading Tools

- Open SMB Scanner (finds Stocks In Play)

- Open SMB Game Plan Template (where I input ideas)

- Sort Scanner by pre-market volume

- Read news of stocks that have unusual pre-market trading activity

- Enter 3-5 ideas in Game Plan Template

- Enter 2nd Day Plays into Game Plan Template

- Discuss market and ideas in AM meeting (15-20 minutes)

- Enter alerts and trading scripts for all trading ideas

This process allows me to settle in and get focused for the Opening Bell. When I crunch the data my win rate is significantly higher for the stocks that I pre plan versus breaking news or market plays that occur during the day.

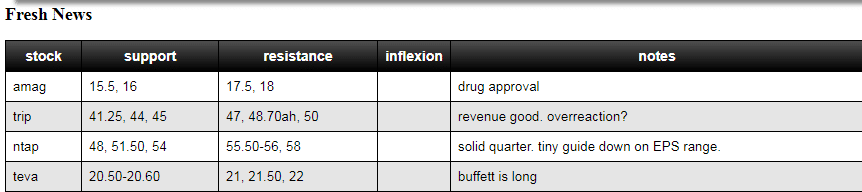

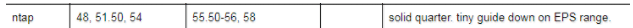

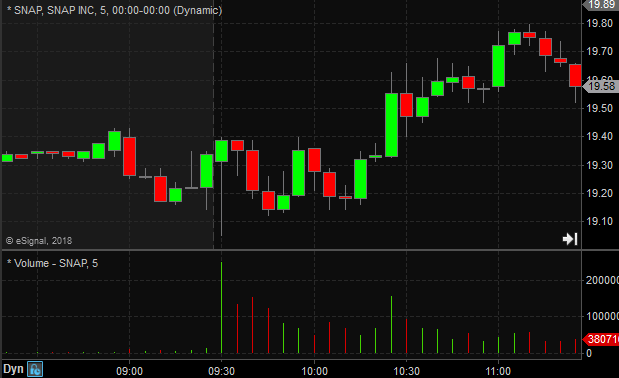

Here is an example of the In Play names I selected from February 15th.

As mentioned above I discuss these ideas in our pre-market meeting and after its conclusion I will enter price alerts and trading scripts based on my bias and the above price levels. Sometimes I will have a strong directional bias based on my view of the bigger picture technical setup, the pre-market reaction to the catalyst and the content of the news. This approach works for me. I believe this “combination approach” as opposed to only looking at a single item increases my win rate. Let’s look at each of the above ideas with some of my notes.

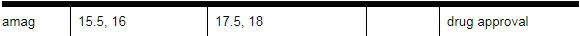

- AMAG (L)–made trade on Open. long against S1. Target R1. Risk 30 cents.

- My general rule on drug approvals is if it is a treatment that would be understood by the general public if discussed on TV there is some upside. Drug was approved to prevent premature births. I did quick research to see what % of mothers this applies to. Roughly 10%.

- On the long term technical side AMAG had been consolidating between 13-15 for a few months so it was setup well as a long on the break of this range

- Support levels were from consolidation range high and gap down area that had established the range.

Entered trade via limit order at 16.10. Scaled out of position into R1. Eventually traded to R2 before settling in between R1-R2 for afternoon. Initial long bias confirmed.

- TRIP (S)–good numbers but gap seems extreme and many people accumulated 50% lower recently.

- Failed in pre-market 48.70 which would be a very good entry

- 47 R1 from GP sheet OK entry. After dropping to S1 on Open popped to R1. i didn’t have alert so missed trade.

- Failed at R1 and trended $4 lower.

On Open bounced from S1 to R1 where it failed twice. Then trended down to S2. Eventually in afternoon almost reached S3. Initial short bias confirmed.

- NTAP (L)--this seemed like a large overreaction on the downside w/ a 1% guide lower on EPS

- It was gapping down to long term support from last quarter’s earnings report. Being close to 20% from ATH seemed like dip buyers likely to emerge

- This was a good example of a stock that was not acting well on the Open. it was trading between S1 and S2. there was a pretty strong argument to dump it based on the price action. But I wanted to give it a chance based on my big picture analysis. Also, the opening print of 54.50 for 750K shares led me to believe that it had a good chance of getting back to this level, which was $2 off the low.

- The buyers didn’t start to take control until midday and it trended another $2 higher to 56 R1. Into the close it almost hit R2. The best spot to press a long trade was around 2PM when volume surged and it had a tight consolidation at 54.50.

This is one of my favorite big picture setups and thus was my main focus for the Open. A stock in a longer term uptrend gaps lower to long term support on news that isn’t that bad. This setup is further bolstered by the longer term bull market. As mentioned above on a micro level it was little tricky on the Open as it was below S1. Notice that initial low was never breached and buyers continued to step up throughout the day never threatening an intraday reversal. Initial long bias confirmed.

- TEVA (N)–it was gapping higher on Warren Buffett taking a position last quarter

- It was gapping into longer term resistance so although i expected some people might get long today on the news it wasn’t a strong enough catalyst for a breakout so plan was to play range from S1 to R1 in either direction

- It opened above R1 so R2 was the spot to look for failure and a trade to S1

TEVA failed at R2 and then traded to pre-market support. It spent the rest of the day in this range. Neutral bias confirmed.

The purpose of reviewing your trades each day is to gather data that will allow you to understand which ideas are working and how you can increase risk taking on those ideas. If at the end of the week less than 50% of my morning ideas didn’t offer excellent risk/reward trades I need to determine what went wrong: Has the market changed? Was my analysis faulty? Are only a certain subset of my trading ideas working currently? Conversely, has a certain type of setup been offering better risk/reward than others? Then this setup should receive more risk allocation and more of my attention.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 21 years. His email address is: sspencer@smbcap.com.

Ne relevant positions

Trade Review–WMT HD SPY

The top In Play names this morning:

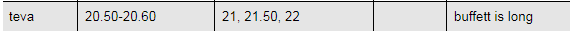

WMT was my focus as the lowering of FY19 guidance was potentially a very strong catalyst. Early indications from pre-market trading were many traders were attempting to dump the stock ahead larger selling that would come after the opening bell. You can see my discussion of WMT in the AM Meeting here.

With a short bias and such a large gap my preferred entry on the Open is after a quick pop to potential resistance areas. I offered 10% at 97.50. 40% at 97.89 and another 40% at 97.99 (this offer wasn’t executed).

As you can see from the chart WMT failed just below 98 and quickly reversed. The speed of the reversal didn’t offer the opportunity to build into a larger position. At 10AM when it flushed below 95 I bought above 94.50 with the assumption that after all the “chasers” and stops were triggered below 95 it would bounce 50 cents to $1. Flat at 95.56.

HD I didn’t have a strong bias but was prepared to trade off of the levels in the game plan. On the Open it bounced from 189 before reaching my first bid. When it failed at 191 it traded down quickly to 188 and my bid was hit. After a quick drop to 187 it popped back above 188. My trailing stop was triggered when it dropped again.

The low print was at S2 but I hadn’t entered a script to get long there and had no price alert. So I missed the $3 bounce from this level. I was trading the WMT bounce at exact time it bottomed so my attention was elsewhere.

SPY plan was to trade long against pre-market low. SPY was due for a pull back friday and the pre-market low $4 from the high was sufficient pull back in my view based on how strong the bounce from the low had been. Script entered to get long 271.12. The other trade in SPY was short into 273 which had been support on Friday. I got alert at 273 and put up an offer at 273.05 and got taken. Stop above 273.20. This trade started to work in a few minutes and I scaled out as it traded back down through 272. This idea was also discussed at the beginning of the AM Meeting.

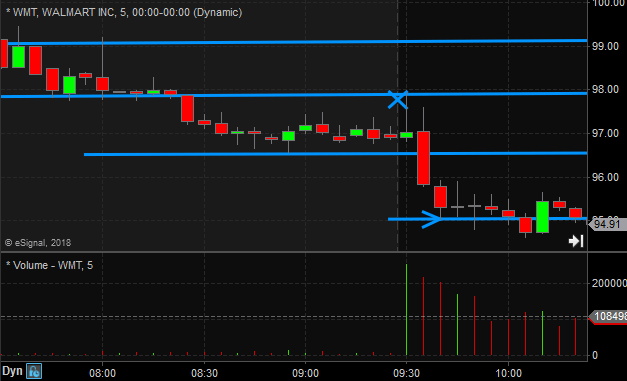

SNAP plan was to fade the downgrade. A buy into 19 seemed like a layup so I entered a script to get long at 19.05. SNAP hit 19.05 but the offer never touched that price so my script never got long. This happens quite often in “real life” trading. If you are picking good prices to get long/short often you will get in close to the bottom/top of short term moves and occasionally you will miss entries by pennies.

The other two In Play names discussed were MGM and UBNT. MGM was mainly for novice traders on the desk because of the higher liquidity and tighter spreads. UBNT was a high risk high volatility setup because of the SEC Supboena. It actually dropped another $8 in the pre-market during the AM Meeting. I entered no trades in it on the Open but discuss the possibility of a flush below 50 before a bounce and eventual roll over down to the 40s.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 21 years. His email address is: sspencer@smbcap.com.

No relevant positions

A struggling trader asks: how do I find my trading style?

I presented at the Scottsdale (Phoenix) Traders and Investors Meetup Group this week and was asked a particularly good question we ought to discuss.

Trader Sean, 80, and frustrated taking thousands of dollars of trading education without profitability asked, “How does a trader know what trading style is best for him?”

I had shared an anecdote of one of our top traders, a Black Shirt earner, who found a niche and grew bigger and bigger. One niche turned him into a Black Shirt Trader. This is the context for Sean’s question.

Let me offers some ideas:

I have been mentoring a 7-figure trader outside of our firm who trades best when he is having “fun” and is “energized”. I noticed a connection between this trader trading at his best and feeling “energy” during a trading session. That connection was staring right there in his Daily Report Card shared with me. I mentored that this was significant information from his trading. The setups that were fostering “energy” and “fun” deserved more attention and size. They were communicating a talent for specific setups.

Further, Dr. Steenbarger taught firm traders today during a firm presentation to think of how you have been successful in the past. Find trading that taps into the talents that have brought prior success. If you are a fast thinker, scalp. If you are a solid analytical thinker, find edge in a news catalyst.

Also, exposure is necessary to find the setups best for you. The reality is you have to try a bunch of different setups and experience whether they might work for you. Learning setups with edge, trading them live, and measuring your results in specific setups is the exposure necessary when developing.

Moreover, a younger and ambitious trader approached me at the event. He said, “It seems like most of the answers are gaining experience.” There is truth to that. Improving on the setups you learn with edge is an important step in becoming a consistent trader.

Finally, one trader at the event hoped to be making real money in Year1 as a trader. We see traders make significant PnL in Year3 of their trading careers. They make some Year1 perhaps. More Year2 for sure. But it is not until Year3 where they are making significant money for firm and themselves. And this is for traders who have all the resources of a firm: capital, technology, coaching and mentoring and experienced traders around them.

It. Takes. Time.

I appreciate your feedback/comments/questions- mbellafiore@smbcap.com.

Thxs to all who attended in PHX.

*no relevant positions

The progress of losing less on your worst days

In a recent Daily Report Card an improving Junior Trader noticed his progress on losing less on his worst days. This is important progress.

The Junior Trader wrote:

Was really quite a back and forth type of day and never really gained much traction. However, I was green, which I was surprised at the end of the day because I really felt like many things didn’t really go my way. This is a good feeling because I know that allot of my trades didn’t work out, but still was able to remain flexible and stay green. This is something that I have been working on and has lead from big red days becoming smaller and smaller. The ability to be flexible and ADMIT WHEN I AM WRONG has saved me on many trades.

We often set a goal to make more in our best trades. Another way to make progress, important progress, is to lose less when we are not seeing screens well.

This Junior Trader has been making terrific progress in his trading of late. His numbers are improving month over month. This is just one way that is happening.

Perhaps you might consider this for your trading.

I am grateful for your comments/feedback- mbellafiore@smbcap.com.

*no relevant positions

SMBU’s Options Tribe Webinar: Matt Williamson of Tacticalspreads.com: Selling Shotguns in a Volatility Apocalypse

February 27th, 2018

This week, Matt Williamson of Tacticalspreads.com will be discussing the weigted vega effect as well as second and third order volatility greeks to offer an explanation for the behavior of volatility curves in black swan events. He will also be offering ideas on theoretical ways of profiting from these events. During the webinar, Seth Freudberg will also be making some comments about changes that SMB’s Options Trading Desk is making to its approach to options trading based on lessons learned from the recent market volatility.

Options Tribe meetings are generally free to the public and are held every Tuesday at 4:30PM ET. If you wish to register to this meeting, please click here.

We look forward to seeing you at the meeting!

Seth Freudberg

Director, SMB Options Training Program

The SMB Options Training Program is an eight-month program designed for novice and intermediate level options traders who are seeking an intensive training process to learn how to trade options spreads for monthly income. For more information on this program contact Seth Freudberg: sfreudberg@smbcap.com.

No relevant positions

Risk Disclaimer

Futures Risk Disclaimer

Trading BOX

If the White House walks back tariffs, then…….

Today on the desk we discussed the importance of creating a plan for if the White House walks back its pronouncement to raise tariffs on steel and aluminum. After this announcement, the markets sold off hard and there were winners and losers.

One of the really fun things traders can do our desk is play with technology. Two traders could be heard discussing building a basket of stocks and products to buy if the tariffs are walked back. They thought about what had been hit hardest to add to their basket and how to build.

During our AM meeting we discussed this possibility as well the potential for follow thru to the downside. We asked our traders to review what did well and what got hit hard yesterday for trading opportunities today.

During our 11AM Trader Development mentoring session, we again discussed what to buy and sell if the White House walked back raising tariffs. Some ideas (not meant to be comprehensive): Buy F, BA, GM, SPY, CMI, CAT. The idea is to review what has been hit the hardest and be ready to buy if a walk back occurs. Some more ideas: Short X, VXX.

This is not a political statement, but a pattern recognition observation. The White House has a history of walking back statements of late. So this is something for which to prepare as a trader.

*no relevant positions