![]()

You want to trade better in 2018.

You develop goals and feel ready to improve. Let me offer perspective from my seat managing a trading desk.

Each year our Floor Manager and I meet with all firm traders to review their yearly goals. We are week 1 into this process this year.

Some best practices have arisen. Common areas that need improvement have visited. I share this post, with lessons we are being taught during these reviews, to help you develop more constructive goals for 2018.

I want to trade bigger!

This is a common goal of traders in our community and firm. What does it take to do so effectively? One of our consistently profitable traders created a wonderful template for us to emulate. First, you must indentify the trading setups that you trade best. You should measure them and demonstrate outperformance in PnL. They ought to have names, these setups. You should be able to describe in detail the variables that make up these trades. And you ought to have a book of examples from 2017 trades of these setups.

One trader listed his 7 best trades and then developed a risk plan to trade all of them bigger. Let’s build on this idea.

Next, develop a risk plan to trade your best setups bigger. How much do you risk on these trades now? How much do you want to increase your risk next month? What is your goal for end of year risk on these trades? Map all of this out for your best trades.

*What if you are a new trader? Well, then you are in the experimentation stage and should be most focused on trying different types of trades and showing PnL edge.

I want to be more consistent!

Great. So far this is just and idea written on paper, next comes the action taken to realize your goals.

How do you become more consistent?

You trades your best setups more often and bigger. You decrease the frequency, risk, and losses in your lesser trades. This is an excellent area to track in daily reviews. You spend a small percentage of each day researching new sources of edge and deploying small amounts of capital until you prove edge.

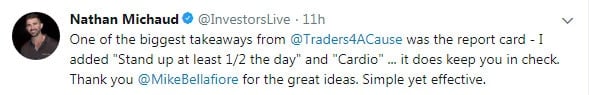

The most thoughtful reviews encompass a holistic plan for improvement in 2018. Sleep. Workouts. Heath. Diet. Fun. Relationships. Family.

2018 will be defined by the daily intensive and effective work you do (best practices turned into habits), that compounds, trading, studying and researching setups with edge best for you, in the right culture for you.

Your feedback/comments/questions are welcome- mbellafiore@smbcap.com.

*no relevant positions