![]()

One scalper on our desk proudly wrote to Dr. Steenbarger and me about his progress recently:

Had 3 personal best this week:

1) Best day: 167K net

2) Best month: 601K net

3) Best year: 1.5M net

Cheers!

$601,000 in net profits is a sensational trading month!

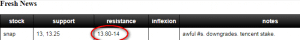

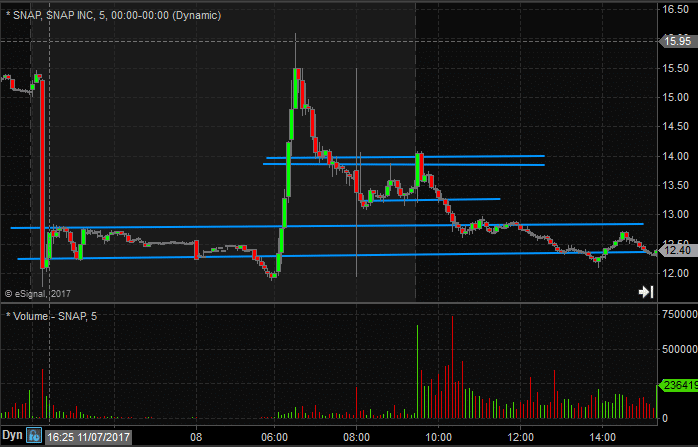

A scalper is a trader who makes very short-term trades. He is active. He focuses mostly on price action and reading the tape. His skill is in placing bets on where the stock is to trade next. And not where the stock or trading vehicle will be on a longer time frame.

This trader had developed goals with Dr. Steenbarger at the start of the year and hit them. Mostly he has worked on trading his edge bigger. That edge is scalping. Where before he might have scalped 5-10k shares in a trade, he is now up to 50k shares in some names.

The firm does not upcharge for trading commissions. We are a PnL firm. So in the case of this trader, he executes at a base rate of 70 cents per thousand shares. There are many prop firms who do mark up commissions, some to as much as $7 per thousand and some even more. This trader is able to recognize enormous net profits because of the firm’s commission structure.

What can we learn from this trader?

You can make real money scalping. I am puzzled at times with statements made in and at the trading community that you cannot. I have read things like: Scalpers earn “crumbs”, while swing traders make real money. You can make real money as a swing trader. Here is a recent post about a firm trader we would describe as more of a swing trader: Why this trader is “crushing it”. Also, and this trader above shows, you can make real money as a scalper.

Play to your strengths. When this trader takes his check to the bank for deposit, they will accept it. They are not going to sit him down and ask him how he made his money. They are not going to refuse the check because his profits were not from fundamentals analysis, trend trading, global macro plays, or swing trading. They are going to accept these “crumbs” at their bank, gladly. He is a great scalper. A winning day trader. So he continues to scalp with larger and larger size.

Embrace Team trading. This trader has also embraced Team Trading. Building a Team where junior traders help him express his edge in markets. Junior traders, who have built technology for this trader, so he can make more of and on his best trades. And with Junior traders who get to learn from a great trader to improve their chances of becoming a successful trader.

Work intensively and purposely on your trading game. Year 2 of his trading career, this trader was consistently a 4-8k a month trader. His results were very consistent as a scalper. Today he remains just as consistent as a trader. But he has worked intensively and purposely to increase his size consistently, with his trading edge. He shows the trading community that if you get to a point in your trading where you can consistently bank 4k a month in trading profits, you can grow a career from there.

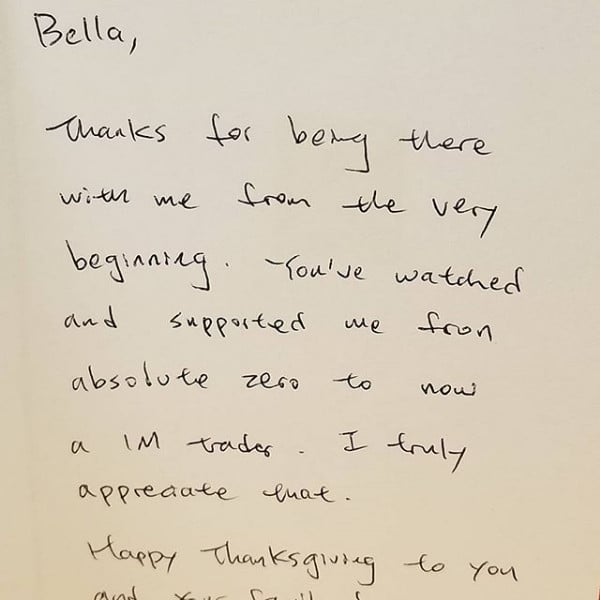

Be one of the good guys in the trading community. We are often inspired to work harder for our trader because of his gratitude:

![]()

Keep raising the bar for the goals you wish to achieve. We will meet with this trader and his Team this month to discuss goals for 2018. Both for his trading personally and his Team. With opportunity, they will expect to do even better, trade even bigger, and hit their new goals.

For those who have an edge in markets, but feel they should be making more or feel they are never going to make enough, perhaps this trader will inspire you to continue forward and achieve your goals.

As always, your comments/feedback are welcome.

*no relevant positions

Related posts

Three key ingredients of trading success