March 3, 2018

Andrew Falde

SMB Options Desk Trader

Yesterday in the Trading Conversations webinar, I was asked for an update on the SPX Netzero Options trades. It was perfect timing because a few minutes before the webinar started, I was approved to put my largest size on the SMB Options Desk into a CL (Crude Oil) Netzero. After mentioning this, several emails and slack room messages came in asking for the reasons for this change. The following answers the common questions which I have been receiving regarding this update to my trading plan.

My shift in focus from index options to commodities options began over a year ago when, in October 2016, I had the opportunity to spend a month at SMB where Merritt Black introduced me to the benefits of the CL futures market.

The cause for my shift from equity indexes to commodities is not because VIX is now too high or that it was just recently too low. It’s that we are facing a regime of large gyrations in Implied Volatility and the potential for extreme IV short covering. The ability to control risk in equity/index options trades is more challenging than it was from 2009 through 2017.

Implied Volatility on equities has become part of a financial engineering game of musical chairs. The music has already stopped one time, and XIV and SVXY are essentially out of the game.

A big factor in the decision to execute any trading strategy is the risk-adjusted return of the strategy. I use potential drawdowns in trades as the denominator and the annual expectancy as the numerator. For now, that relationship is not adequate for me to trade negative Gamma index options trades. The only solutions I have found for the current environment come with extreme complexity, tremendous execution risk, and rapidly increasing commission cost to expectancy ratio.

The commodities futures markets are not a part of this financial engineering game and CL has the key characteristics needed for good option spread trading, and with much more favorable risk vs. reward. Some other benefits of CL options are that they are easier to fill, trade overnight, have a great vol skew for trading both sides of the market, etc.

Something that I’m very excited about is that the Netzero concept and it’s 60-40-20 trade plan have converted over to CL without a single modification. There are some differences to get used to (the 1,000 multiple instead of 100, low price underlying, splitting strikes more often), but these issues are quite minor and take only a few days to get used to.

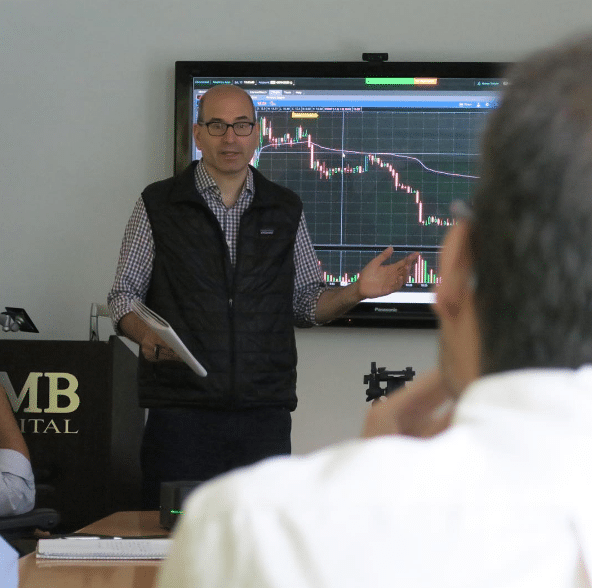

We are actively discussing the CL Netzero trade in the Options and Systems Workshop, and I hold a live Workshop Meeting every Wednesday to discuss various topics including CL Netzero, volatility trading, long and short options strategies for equities, algorithm development, market statistics, and more.

The Workshop Slack room is the best place to get ahold of me, have discussions, and work with other traders that are seeking to improve their trading; and I would love to have you try it out.

You can learn about the workshop at smbu.com/workshop

-Andrew Falde