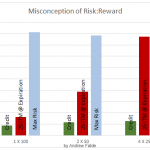

When analyzing a vertical based credit spread, including iron condors and butterflies, the first question that usually comes up is where to place the short strike. In a distant second usually comes the question of where to place the long strike, that is how wide the spread will be. This leaves some analysis to be done on using more contracts for narrow spreads or fewer contracts for wide spreads.

At first glance it seems to be a better deal to narrow your spread and double the number of contracts. This is a major misconception I had about credit spreads when I started trading and later discovered the real trade off which I will Read more [...]

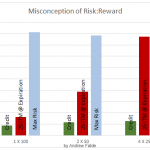

When analyzing a vertical based credit spread, including iron condors and butterflies, the first question that usually comes up is where to place the short strike. In a distant second usually comes the question of where to place the long strike, that is how wide the spread will be. This leaves some analysis to be done on using more contracts for narrow spreads or fewer contracts for wide spreads.

At first glance it seems to be a better deal to narrow your spread and double the number of contracts. This is a major misconception I had about credit spreads when I started trading and later discovered the real trade off which I will Read more [...]

When analyzing a vertical based credit spread, including iron condors and butterflies, the first question that usually comes up is where to place the short strike. In a distant second usually comes the question of where to place the long strike, that is how wide the spread will be. This leaves some analysis to be done on using more contracts for narrow spreads or fewer contracts for wide spreads.

At first glance it seems to be a better deal to narrow your spread and double the number of contracts. This is a major misconception I had about credit spreads when I started trading and later discovered the real trade off which I will Read more [...]

When analyzing a vertical based credit spread, including iron condors and butterflies, the first question that usually comes up is where to place the short strike. In a distant second usually comes the question of where to place the long strike, that is how wide the spread will be. This leaves some analysis to be done on using more contracts for narrow spreads or fewer contracts for wide spreads.

At first glance it seems to be a better deal to narrow your spread and double the number of contracts. This is a major misconception I had about credit spreads when I started trading and later discovered the real trade off which I will Read more [...]